Uniqueness Of Osun Financing Strategies

Maximisation of social welfare of the society forms the essence of any government throughout the world, and the metric of performance of an administration is usually calibrated along the lines of security of lives and properties, and provision of social goods.

Maximisation of social welfare of the society forms the essence of any government throughout the world, and the metric of performance of an administration is usually calibrated along the lines of security of lives and properties, and provision of social goods.

The desire of any government in maximixing the welfare of its people is reflected in the manner of policies and programs it pursues. These are in turn a reflection of its annual budgets, which sets the tones of any administration in any given year.

Ideally, government determines its expenditure pattern from its fiscal policies. The desire of any government is to ensure it generates enough revenue to sustain its planned expenditure. As applicable to individuals and private organizations, where government is unable to generate enough revenue however, the excess spending needs to be financed through leveraging.

Borrowing by government is actually not a crime, as long as the proceeds of such inflow are judiciously utilized for societal development in form of infrastructure transformation and mandatory social welfare. While long term loan can be secured by government for infrastructure development, occasional challenges arise where the recurrent expenditure of government cannot be met immediately from its recurrent revenue, particularly due to delay in time of receiving such revenue. In this case, government needs some financing strategies to keep pace with its obligations to the governed. One of such strategies that has global recognition, particularly in advanced economies is “Ways and means” advances. This strategic way of stabilizing government machineries first became popular in India around 1930. This financing initiative was first institutionalized by the Reserve Bank of India (India Central Bank). Under this scheme, the Reserve Bank of India extends short term advances to the country’s state governments that maintain accounts with the bank. These short term advances are used to bridge any gaps that might arise for short time between the expenditure and receipts of state governments. They are meant to provide a cushion to the states to carry on their essential activities despite mismatches on fiscal transactions and to avoid disruptions to the normal and necessary financial operation of states.

Given the unprecedented delay on receipt of allocation from the Federation account in the recent time, and the excessive interest rate on commercial loans, agitation for way and means advances from the Central Bank of Nigeria (CBN) may not be out of place. This is necessary to minimize the severe impact of delayed allocation from Federation account on government and the citizens. A situation where government cannot pay salary of her workers promptly as a result of the habitual delay in Federation allocation is detrimental.

For us in Osun, our strategy actually mirrors “Way and means”, though within the financial institutions’ domain.

Of course, we are all aware that states’ allocations from the Federation account are made in arrears, the usual delay in receipt of these allocations, which in most times can be up to one or two months implies that mandatory expenditure of the state such as security, salaries and overheads of the government would be outstanding until receipt of allocations. Given our desire for good governance, and borne out of our strategic initiatives, our administration has been meeting its numerous obligations by resulting to different creative ways such as savings and application of “ways and means” particularly to finance salary payments at least twenty five (25) days before receipt of allocations. It should not be forgotten that as part of the current government’s resolutions to ensure that workers are well motivated to ensure robust productivity, prior to the end of 2013, the state ensured payment of workers’ salaries on 25th of every month.

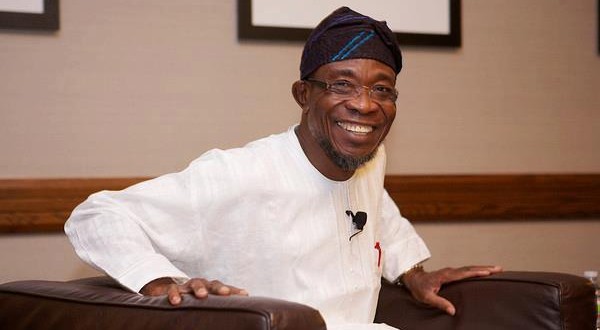

Contrary to what obtained under the last administration in the state where huge excess crude oil revenue collected from the Federation account (up to over N40billion) was frittered, Ogbeni Rauf Adesoji Aregbesola denied himself and saved the excess crude funds for the state and encouraged the local governments to also save theirs. The total savings built up to about N30billion. The Governor consequently created Omoluabi Conservation Fund to take care of future generation, infrastructure needs and shortfall in revenue. It was this saving edge that was used to create a Deposit draw back facility that was used to finance the salary payments promptly on 26th of every month for three (3) years, despite the delay of one or two months before receipt of federation revenue. This edge allows the state to swap the interest rate and minimize the cost to three (3) percent per annum. This creative structure actually mirrors Ways and means advance of Reserve Bank of India. Incidentally, part of the referenced savings has been applied on the state’s various infrastructure roll out, without compromising the statutory responsibilities of the state.

In our opinion, the unabated delay in monthly revenue sharing from the Federation account is capable of grounding the workings of government, particularly State and local governments and create an unfavourable impression about states governments sustainability.

We therefore wish to make case for this ingenious ways of bridging the monthly delay on revenue allocation from the Federation account. This call cannot be more timelier given the recent assumption of office by the new Governor of the Central Bank of Nigeria (CBN).

Only few states in the country can boast of robust internally generated revenue and adequacy of same to take care of their critical expenditure before receipt of their monthly allocations. It is therefore our hope that other states’ governments across the country will lend their voices to this pragmatic financing strategy. The benefits remain bridging the unending delay in receipt of revenue from federation account at minimal cost, while maximizing social welfare.